Overview & Pool Types

Curve offers a permissionless system for deploying liquidity pools — no DAO vote, no approval process, and no technical barrier beyond the gas cost to deploy. A full-featured interface is available in the Curve app, so you can launch a custom pool without writing any code.

To get started quickly, follow one of the deployment guides:

Factories make launching pools on Curve fast, flexible, and accessible to any project—whether you're a stablecoin issuer, LST protocol, synthetic-asset platform, or any other DeFi team looking to bootstrap deep, reliable liquidity.

How are Pools Deployed?

In the background, new liquidity pools are deployed by making use of a Pool Factory, which essentially is a smart contract for deploying new pools. Each factory contains the logic and configuration for a specific pool type. Factories support a few different pool types:

- Stableswap — for pegged or correlated assets (e.g., USDC/USDT, stETH/ETH)

- Cryptoswap — for more volatile or uncorrelated assets (e.g., ETH/USDC)

- FXSwap - for lower-volatility assets like Forex pairs, or lower volatility Crypto pairs like BTC/ETH.

Once a factory is deployed, anyone can create a new pool of that type — either through the Curve UI or directly on-chain.

Pool deployment is completely free of charge beyond standard gas costs. There are no additional fees, no protocol charges, and no hidden costs associated with deploying a new pool on Curve.

Pools deployed via a factory appear automatically on the Curve frontend after a short propagation period and are picked up by aggregators such as 1inch and CowSwap. You don't need to chase integrations.

Choosing the Right Pool Type

Curve supports multiple pool designs to fit different kinds of assets. Selecting the correct type is essential to ensure low slippage, efficient trading, and capital-efficient liquidity.

Not sure which to use? Reach out in the official Curve channels.

Stableswap Pool

Choose a Stableswap pool when your assets are expected to stay close or correlated in price — e.g., stablecoins (USDC/USDT), LSTs (wstETH/stETH), or yield-bearing stable assets like sDAI. Learn more here: Understanding Stableswap.

Stableswap-NG pools support a wide variety of token types beyond standard ERC-20 tokens. This flexibility allows you to create pools with yield-bearing tokens, rebasing tokens, and oracle-enabled tokens.

Supported Asset Types:

| Type | Description | Use Cases | Examples |

|---|---|---|---|

| 0 | Standard ERC-20 | Basic tokens with no special features | USDC, USDT, DAI |

| 1 | Oracle-enabled | Tokens with rate oracles for accurate pricing | wstETH, cbETH |

| 2 | Rebasing | Tokens that change supply over time | stETH |

| 3 | ERC4626 Vault | Yield-bearing vault tokens | sDAI |

Technical Requirements:

- All tokens must be ERC-20 compatible (return True/revert, True/False, or None)

- Maximum 18 decimals supported

- Oracle tokens must have precision

- ERC4626 vaults support arbitrary precision for both vault and underlying tokens

Cryptoswap

Choose a Cryptoswap pool when your assets are more volatile or uncorrelated—e.g., ETH/USDC or BTC/USDC. Cryptoswap pools use dynamic pricing that handles larger price swings while still retaining Curve’s efficiency advantages. Learn more about Understanding Cryptoswap.

FXSwap

FXSwap is designed for uncorrelated low-volatility asset pairs like Forex (e.g., crvUSD/EURC) or lower volatility crypto pairs (e.g., BTC/ETH). It combines Stableswap's mathematical efficiency with Cryptoswap's dynamic rebalancing framework, plus a "refueling" mechanism that allows projects to fast-track rebalancing with external incentives. Learn more about Understanding FXSwap.

Base Pools and Metapools

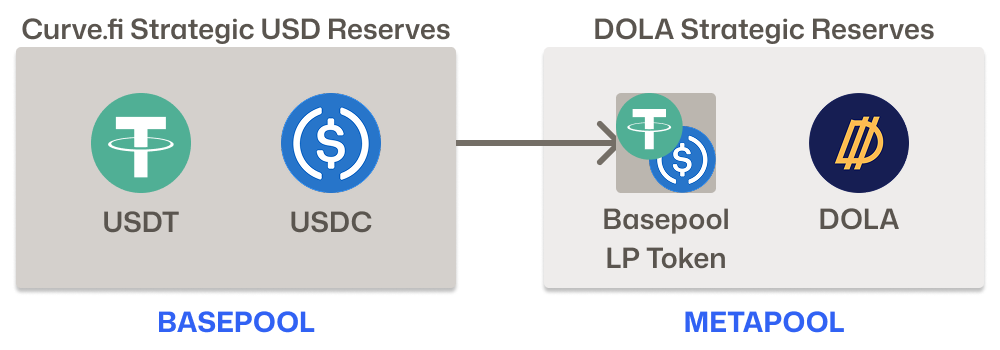

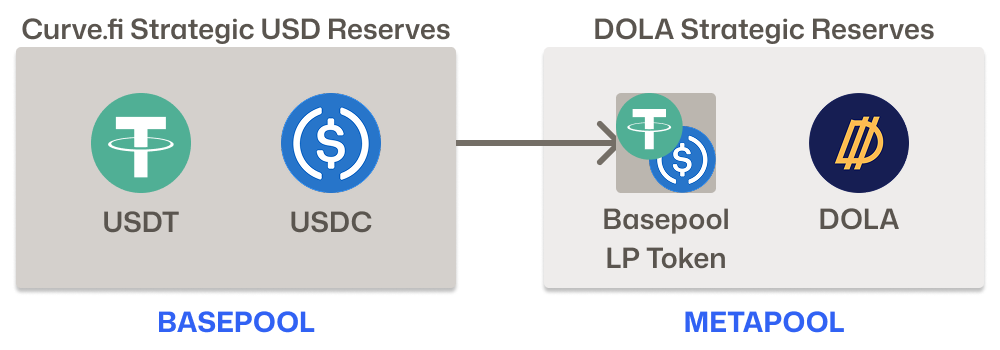

Stableswap pools on Curve support a powerful structure of base pools and metapools.

- A base pool is a regular Curve pool that the DAO has specifically approved to be used in metapools.

- A metapool pairs a token against an existing base pool rather than against a single token.

For example, the USDC/USDT pool might begin as a normal Stableswap pool. If the DAO adds it as a base pool, it can then be reused in other pools. A protocol such as Inverse can create a metapool that pairs their stablecoin DOLA against the base pool, resulting in a DOLA–USDC/USDT market. Users can directly swap DOLA/USDT or DOLA/USDC through this pool.

This approach gives new tokens a major advantage: they can tap into the deep, established liquidity of the base pool instead of needing to attract all liquidity themselves by pairing their token against an already existing and established pool with TVL.